Superstate is

modernizing finance

We build investment products that benefit from the speed, programmability, and compliance advantages of blockchain tokenization.

Read More

Funds

Introducing the first tokenized fund from Superstate.

Superstate Short Duration US Government Securities Fund

The Superstate Short Duration US Government Securities Fund (USTB) is a private fund tokenized on the Ethereum blockchain, offered exclusively to Qualified Purchasers. Learn More

Assets Under Management

$106,783,532.51

7-Day Yield

5.36%

NAV per Share

$10.181110

How it works

Learn how Superstate's tokenized funds work, and why they are trusted by investors, corporate treasuries, protocols, and intermediaries.

Earn Yield

Hold USTB to earn yield tied to the US Fed Funds rate. Get exposure to short-term interest rates managed by professional portfolio managers.

-

Token does not rebase, and yield accrues to the NAV price

-

Immediately accrues yield enabling compounding returns

-

Value accrues without airdrops or income distributions

-

Low 0.15% management fee

Easy Purchases and Redemptions

Purchase USTB onchain with USDC, or offchain with U.S. Dollars. Ready to redeem? Transfer tokens to the burn address to receive payouts in either USDC or U.S. Dollars.

-

Purchase or redeem USTB with USDC, or buy directly with U.S. Dollars

-

Receive payouts in USDC or US Dollars

-

Daily liquidity on Market Days

-

Initial minimum purchase of $100k, with no subsequent min or max

Flexible Custody

Hold USTB in self-custody or at major crypto custodians. Not ready for tokens yet? Hold shares offchain and mint tokens on demand

-

Receive USTB as tokens or hold shares offchain and mint on demand

-

Store at leading custodians like Anchorage and BitGo

-

Compatible with self-custody and smart contract wallets

Clear Regulatory Structure

Our funds operate within a simple regulatory framework so you can focus on the utility of USTB.

-

Headquartered in the U.S. with a Bankruptcy-Remote Trust Structure

-

Assets are managed by and segregated at established service providers

-

Available to investors in the U.S., British Virgin Islands, and Cayman Islands

-

Transfer token between vetted counterparties

Built for DeFi

We are focused on building tokenized funds that benefit from the speed, programmability, and compliance advantages of tokenization.

-

USTB is a simple Ethereum-based token

-

Use for collateral and settlement

-

Uses Encumber, enabling permissioned ERC-20s, like USTB, to be used in decentralized finance protocols

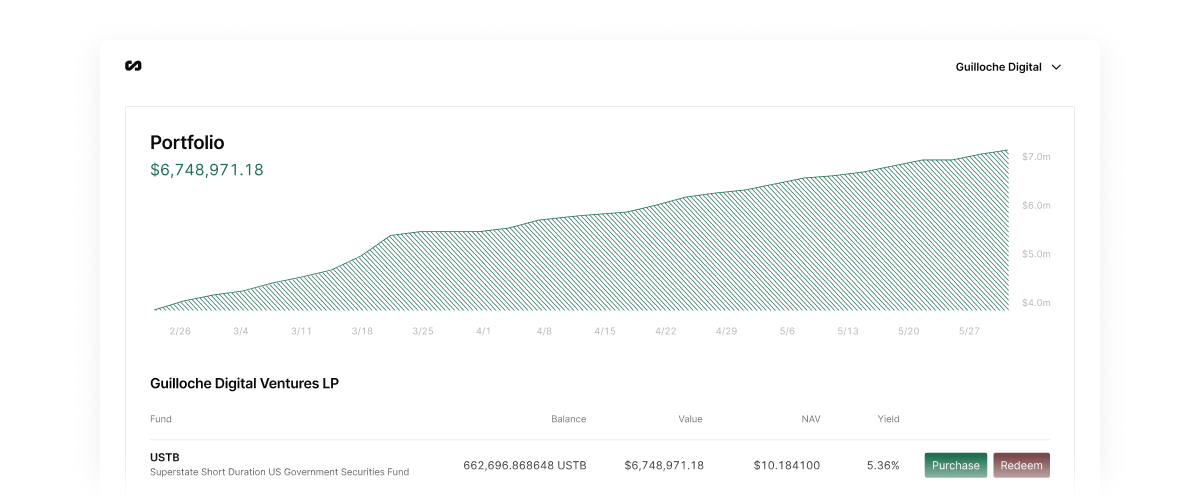

Comprehensive Investor Portal

Convenient access to statements, reports, balances, and account management through our easy-to-use portal.

-

Unified view of your Superstate fund portfolio

-

Download statements and reports

-

Track live and historical transactions

-

Manage your team, addresses, and settings

The Superstate Industry Council (SIC)

The Superstate Industry Council is a collective of top traditional and digital asset investment institutions committed to shaping Superstate’s product roadmap and advancing the adoption of tokenization within traditional financial services and capital markets.

Read MoreReady to get started?

Connect with our business development team to learn about our tokenized investment solutions.