Superstate is

modernizing finance

We build investment products that benefit from the speed, programmability, and compliance advantages of blockchain tokenization.

Read More

Our funds

Introducing tokenized funds from Superstate.

Superstate Short Duration US Government Securities Fund

USTB offers Qualified Purchasers access to income from short-duration Treasury Bills, with minimal fees.

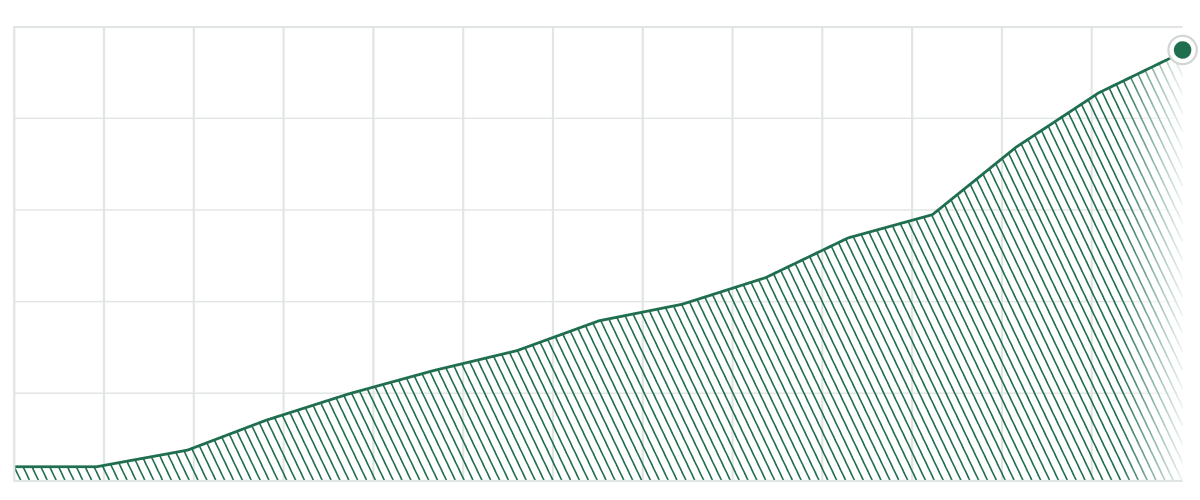

Assets Under Management

$153.59M

NAV per Share

$10.419257

7-Day Yield

4.88%

Superstate Crypto Carry Fund

USCC offers Qualified Purchasers access to excess returns derived from the crypto basis trade, staking, and government securities.

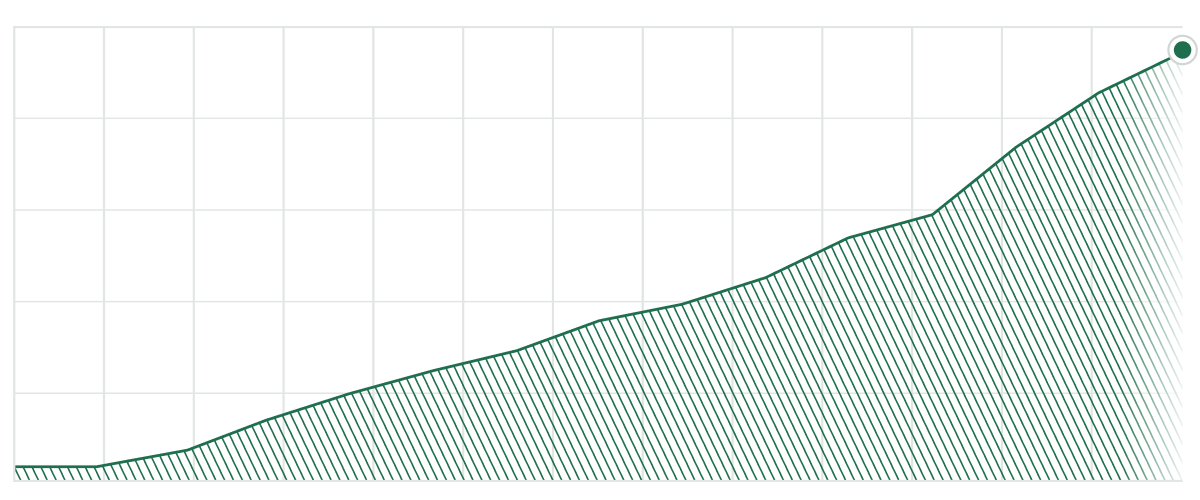

Assets Under Management

$43.68M

NAV per Share

$10.259143

30-Day Yield

1.97%

Our advantage

Learn how Superstate's tokenized funds work, and why they are trusted by investors, corporate treasuries, protocols, and intermediaries.

Daily liquidity

Purchase Superstate funds on-chain with USDC, or off-chain with U.S. Dollars. Ready to redeem? Transfer tokens to the burn address to receive payouts in either USDC or U.S. Dollars.

-

Purchase or redeem with USDC, or buy directly with U.S. Dollars

-

Receive payouts in USDC or US Dollars

-

Daily liquidity each Market Day

-

Initial minimum purchase of $100k, with no subsequent min or max

-

USDC is supported on both Ethereum and Solana networks

Built for DeFi

Superstate funds are designed from the ground-up by a DeFi-native team to work seamlessly with DeFi protocols in a compliant way.

-

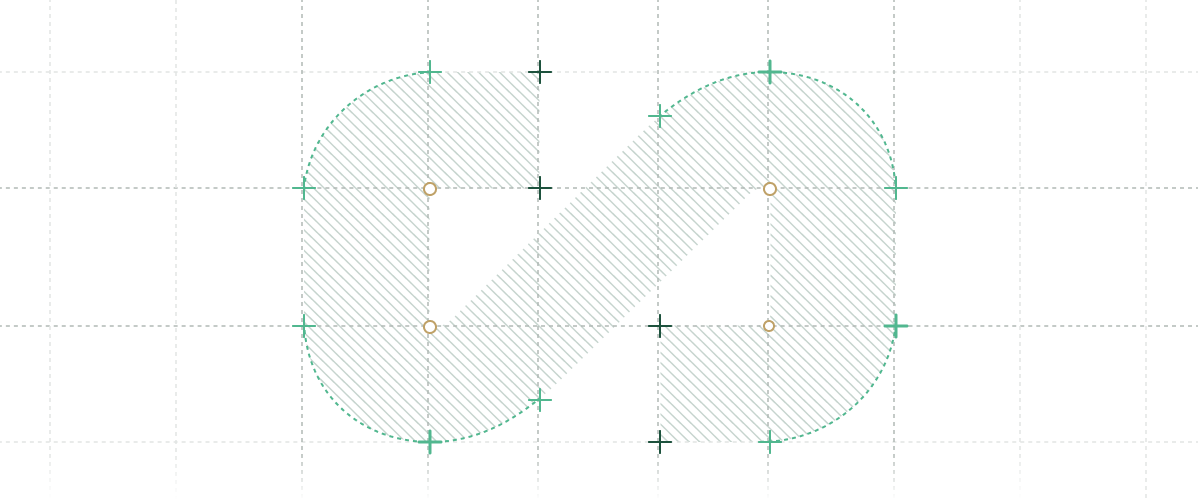

Superstate funds are Ethereum ERC-20 tokens with additional functionality

-

Tokens may be transferred between Allowlist participants and used as collateral, in settlement transactions, or for on-chain finance

-

Minimize counterparty risk with a customizable Allowlist

Simplified income & accounting

Our funds are structured to be efficient and simplify your operations.

-

Tokens represent shares of the fund

-

Return accrues daily through appreciation of the NAV/share

-

There are no distributions, airdrops, or price-rebasing of the token

-

K-1 tax statements are provided to assist in tax compliance

Flexible ownership

We designed Superstate funds to easily integrate with your existing workflows and custody solutions, whether you manage a crypto native fund, a DAO, or a traditional fund.

-

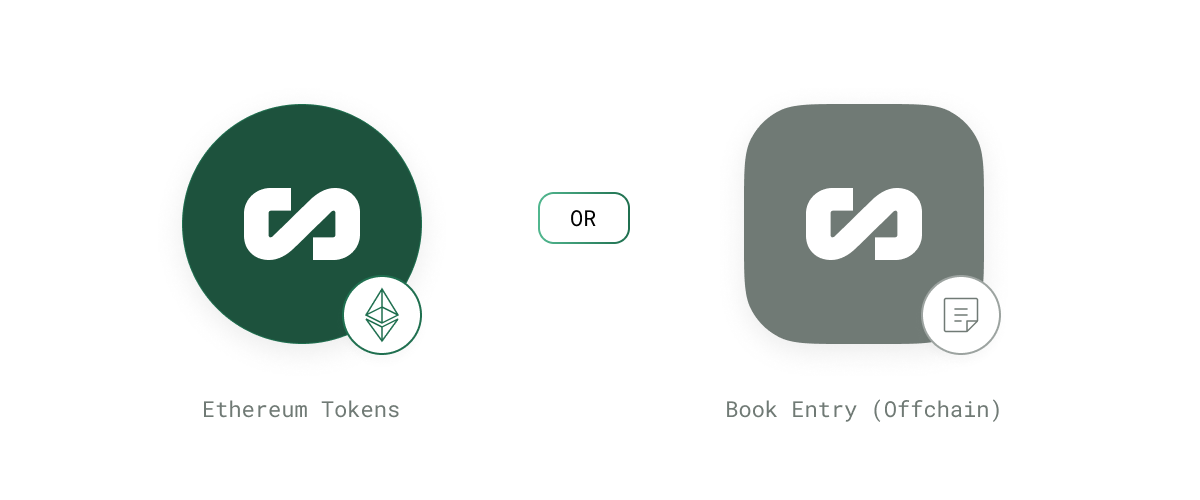

Hold funds as ERC-20 tokens inside your existing custody solution, including self-custody or custodians like Anchorage and BitGo

-

Not ready for tokens? Hold Superstate funds in Book-Entry and mint tokens when you’re ready for on-chain finance

Clear regulatory structure

Our funds operate within a simple regulatory framework so you can focus on utility and yield.

-

Headquartered in the U.S. with a Bankruptcy-Remote Trust Structure

-

Assets are managed and segregated by established service providers

-

Available to Qualified Purchasers in supported jurisdictions

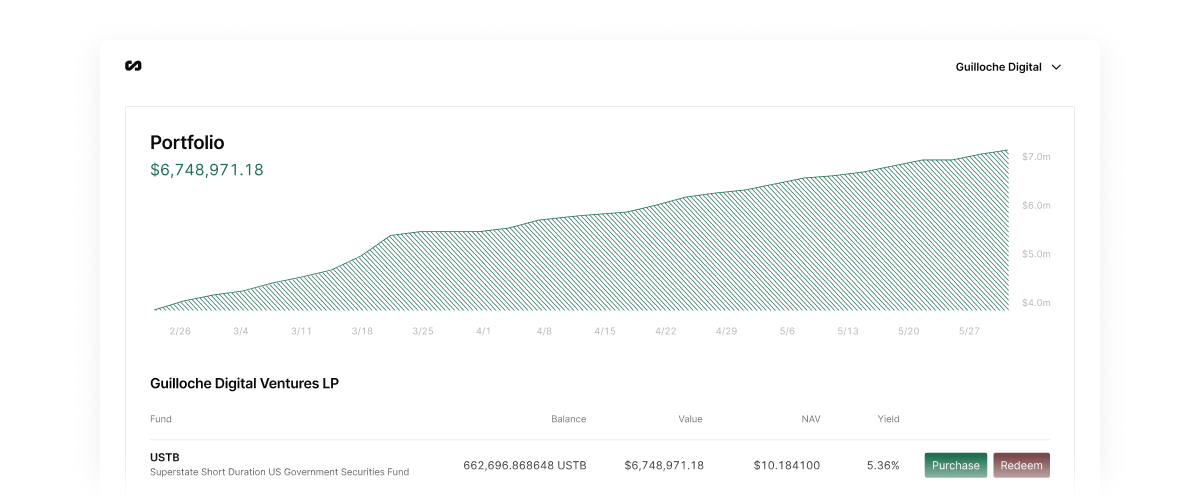

Comprehensive investor portal

Convenient access to statements, reports, balances, and account management through our easy-to-use portal.

-

Unified view of your Superstate fund portfolio

-

Download statements and reports

-

Track live and historical transactions

-

Manage your team, addresses, and settings

The Superstate Industry Council (SIC)

The Superstate Industry Council is a collective of top traditional and digital asset investment institutions committed to shaping Superstate’s product roadmap and advancing the adoption of tokenization within traditional financial services and capital markets.

Ready to get started?

Connect with our business development team to learn about our tokenized investment solutions.