Superstate Industry Council Welcomes Third Cohort of Leading Institutions

We are thrilled to announce the induction of our third member cohort of the Superstate Industry Council (SIC)*. This diverse group of institutions joins us in shaping Superstate’s product roadmap and driving the adoption of tokenization within traditional financial services and capital markets.

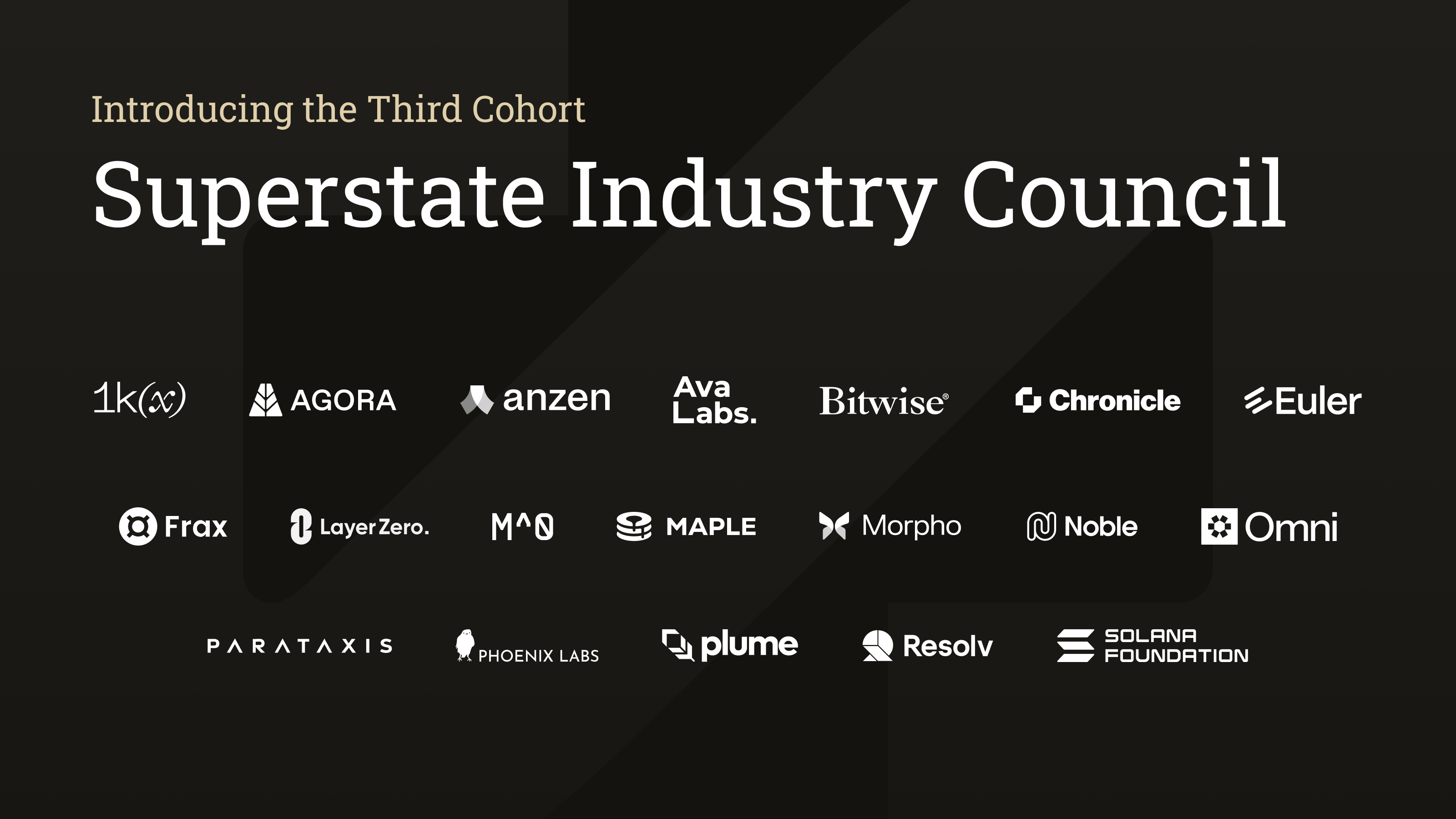

Introducing the Third Member Cohort

Since the inception of the council in March 2024, dozens of organizations across the ecosystem have seen the efficacy of SIC’s efforts and sought to join the Council. We are proud to welcome 20 leading institutions to our third member cohort. These members bring a wealth of experience from both TradFi and DeFi, specializing in areas such as trading, market making, custody, prime brokerage, exchanges, investing, blockchain infrastructure, cross-chain interoperability, decentralized finance, institutional lending, stablecoins, and structured financial products. They include:

1kx is a global venture investment firm that partners with forward-thinking founders, protocols, and communities to help grow the crypto ecosystem.

Agora is building a monetary network and infrastructure through their fiat-backed stablecoin, AUSD, that will power the future of trading, FX, payments, financial apps, and stablecoins.

Anzen is the issuer of USDz, a multichain digital dollar backed by a diversified portfolio of private credit assets. By bridging real-world assets with DeFi, Anzen provides institutional-grade stability and yield opportunities for on-chain investors.

Ava Labs is a leading blockchain technology company dedicated to empowering organizations to build scalable decentralized applications (dApps) and custom blockchains. Headquartered in New York City, Ava Labs is driven by a dynamic team that creates cutting-edge tools for developers, enabling them to harness the power of the community-driven Avalanche Blockchain Network. Ava Labs supports the launch of Avalanche Layer 1 blockchains, helping clients—from startups to government agencies, financial institutions, gaming companies, and telecoms—transform industries and pioneer new ones.

Founded in 2017, Bitwise is a crypto asset manager with more than $12 billion in client assets and a broad suite of professional investment products spanning ETFs, private funds, active solutions, separately managed account strategies, and staking.

Chronicle is a pioneering oracle protocol delivering secure, transparent, and verifiable real-time data for the on-chain economy. With a proven track record in Real-World Assets data infrastructure, Chronicle has secured billions in assets for major DeFi ecosystems like Sky (formerly MakerDAO) since 2017. Trusted by institutions, builders, and tokenized asset issuers, Chronicle powers the data infrastructure essential for transparency and trust in financial assets and applications.

Euler revolutionizes DeFi by letting any asset become collateral for a lending market. Lenders and borrowers get market leading risk-adjusted rates. Builders can create and manage markets exactly how they want them, with institutional-grade security.

Frax is a decentralized financial ecosystem focused on stablecoins, lending, and real-world asset integration. Known for its innovative Frax stablecoin (frxUSD) and yield-bearing assets like sfrxETH & sfrxUSD, Frax aims to be the onchain financial engine of the internet.

LayerZero is the interop protocol. It empowers businesses to use crypto to create scalable, secure, and seamless products—from tokens to apps to full-scale companies. LayerZero currently connects $200B in assets and 300+ applications across 127 chains and counting.

M^0 is the platform powering builders of safe, programmable, interoperable stablecoins. By extending $M, a digital dollar building block issued by the M^0 protocol, developers can build branded, feature-rich digital dollars in minutes.

Maple Finance, founded in 2021, is an institutional asset manager offering a suite of on-chain products designed for accredited investors. Maple provides secured lending, structured products, and institutional staking, all underpinned by a transparent and verifiable protocol infrastructure. By bridging accredited capital with on-chain markets, Maple is shaping the future of digital asset credit.

Morpho is a permissionless decentralized lending platform that operates on two levels. For builders, a flexible infrastructure stack and a suite of tools that empowers developers and businesses to build custom applications in a trustless way. For users, tailored solutions to earn and borrow on their terms.

Noble is a blockchain purpose built for stablecoin real-world asset (RWA) use and interoperability. Noble combines minimalistic, high security architecture with the cross-chain efficiencies of modular protocols like IBC to bring native stable pin liquidity to 49+ chains.

Omni is an intent network that removes the need for bridges, allowing users to interact with apps across different chains.

Parataxis Capital is a multi-strategy investment firm focused on the digital asset sector.

Phoenix Labs is a research and development company specializing in decentralized finance (DeFi) solutions. The company contributes to platforms like the Spark, leveraging deep expertise in the Sky (formerly MakerDAO) ecosystem to drive innovation in DeFi.

Plume is the first full-stack L1 RWA Chain and ecosystem purpose-built for RWAfi, enabling the rapid adoption and demand-driven integration of real world assets.

Resolv is a protocol that maintains USR, a stablecoin fully backed by ETH and pegged to the US Dollar. Its delta-neutral design ensures price stability and is backed by an innovative insurance pool (RLP) for added security and overcollateralization.

Solana is a blockchain built for mass adoption. It’s a high performance network that is utilized for a range of use cases, including finance, NFTs, payments, and gaming. Solana operates as a single global state machine, and is open, interoperable and decentralized. The Solana Foundation is a non-profit foundation based in Zug, Switzerland, dedicated to the decentralization, adoption, and security of the Solana network.

Purpose & Impact

Now comprising 50+ institutions across multiple sectors, the Council has played a crucial role in the creation and refinement of key offerings, including the Superstate Short Duration U.S. Government Securities Fund (USTB)and the Superstate Crypto Carry Fund (USCC), with more to come in 2025.

Beyond product development, SIC members have forged partnerships and provided invaluable strategic guidance, influencing the development of various novel feature upgrades such as Continuous Pricing and Protocol Mint and Redeem. These innovations have enhanced Superstate’s market infrastructure for USTB, offering 24/7/365 fund management and seamless integration for developers.

This expansion follows notable use cases executed by our members. Steakhouse Financial launched a USDC RWA Vault on Morpho, incorporating USCC as collateral. This marked Superstate’s first DeFi integration. Omni Network integrated USTB for treasury management, leveraging tokenized Treasuries to optimize their balance sheet. And stablecoin issuers such as Frax, Resolv, and Anzen have also integrated Superstate’s tokenized funds into their collateral frameworks, enhancing stability and liquidity within decentralized finance ecosystems. Additionally, M^0 supports USTB, making it the first tokenized money market instrument eligible as collateral for all stablecoins powered by the network.

Members are actively forming new partnerships, which will be announced throughout 2025, creating new opportunities to integrate traditional capital markets with blockchain technology.

Join the Superstate Industry Council

As Superstate redefines traditional financial infrastructure, the continued growth of the SIC represents a significant milestone for both the Firm and the broader tokenization sector. We are committed to expanding SIC’s membership and broadening our offerings.

To learn more about the Superstate Industry Council and how to become a member, please email ir@superstate.co.

Disclosure:

*SIC members’ role is not managerial and input provided will be non-binding and suggestive. No investment advisory services will be provided to Superstate by SIC members in connection to their participation.

**The Superstate Short Duration US Government Securities Fund (USTB) and The Superstate Crypto Carry Fund (USCC) are limited to Investors that meet certain criteria. Investors will be required to provide certain personal and financial information before eligibility to participate in this offering is determined. The information gathered is to ensure compliance with applicable laws including anti-money laundering as well as “qualified purchaser” status, as defined under the Investment Company Act of 1940, and “accredited investor” status, as defined under the Securities Act of 1933. No investment should be made until offering and Fund related documents, which are available upon request, are thoroughly reviewed and understood.

Superstate is currently exempt from registration with the U.S. Securities and Exchange Commission in reliance on the private fund adviser exemption under the Investment Advisers Act of 1940. Information about Superstate can be found by visiting the SEC website www.adviserinfo.sec.gov and searching for our firm name. Neither the information nor any opinion expressed is to be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice.